In January 2012, I came across a blog called Mr. Money Mustache. MMM is part of a community of blogs that promote the Early Retirement philosophy – using a very high savings rate to retire after relatively few years of working and receiving a ‘decent’ income (in American terms). For example, MMM uses compound interest calculations to show that if you save 70% of a US$60,000 per year income, you can retire after 8.5 years with over US$550,000 in the bank. You then live off the interest of this lump sum for the rest of your life and can stick it to the man.

The key to making this plan work for your life is frugality. No nice cars, no expensive restaurant dinners, no fancy vacations. For ten years your focus is on saving every dollar you can because each dollar is your employee – you can either fire him through consumption, or put him to work for you. If you put him to work, you reap exponential rewards because of compound interest. I decided to try this out in 2012.

This idea appealed to me because I don’t want to work for someone else for very long. I don’t believe in our modern working structure where you spend the best years of your life grinding away for someone else and only get to enjoy your life after 40 years when you’re old and grey. I want to enjoy all of my life, as much as possible. In fact, I don’t really want to ‘work’ at all. If I were a trust fund baby, I would spend my time traveling and writing books. MMM showed me that this lifestyle wasn’t reserved just for trust fund babies or Internet millionaires. Anyone can access this lifestyle if they have a very concrete plan to get there.

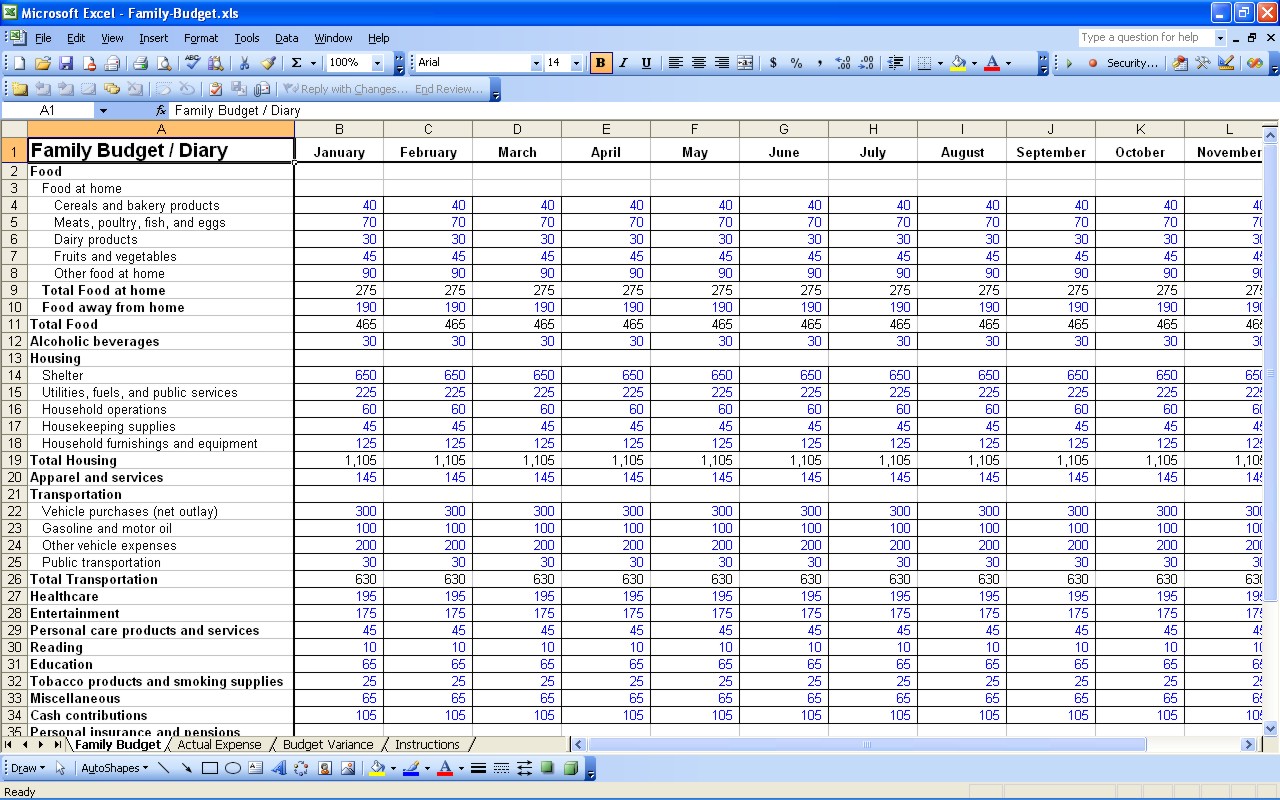

I decided to try the frugality thing for a while and spend as little as possible to pay off as much debt as possible as quickly as I could. I developed a crazy spreadsheet to track how I was doing. There was a sheet for each month where I tracked what I spent on each item each day; then there was a yearly sheet that showed all the months side by side so that I could see my progress over time.

The results were surprising. For instance, I was shocked by how much money I spent on lunch. I was trying to eat a salad everyday, and I spent on average J$1,000 (US$12) per day on lunch, or J$30,000 (US$330) per month. This was just lunch! It doesn’t include dinner, drinks, the movies, grocery shopping, rent, debt, utilities, cable, etc. Many of these other categories were surprising as well.

Over time, just by being more aware of what I spent, I was able to stabilize my spending and make a small dent in my debt, but I never hit the 60-80% savings rate that MMM proposes. Not even close.

I’m starting to work on the second half of the plan – once you stabilize spending, find ways to increase your income, while keeping spending constant to hit that 60-80% savings rate. Wish me luck!

This is a great post. The earlier we all begin thinking about our financial future, the better off we’ll be. I am definitely more frugal than I ever have been. I look forward to trying MMM’s approach. Thanks for sharing!

Thanks for commenting Char! I became obsessed with his blog earlier this year. A treasure trove of info.

I share the sentiments of your blog and look forward to keeping up. Part 2 should be interesting….

Thanks! Hopefully an awesome part 2 after my book comes out!

Wow. Saving 70% of 60K. That’s living off of 18K a year. Seems impossible. But it makes sense if you plan on retiring one day. The key is frugality. We too often base our material wants on what someone else has. And then we go out and buy the Benz and the condo that takes our entire check. Thanks for the info.

Exactly! There’s a whole community of bloggers who live the frugal life in order to become millionaires. It’s a rough transition at first, because there are social pressures to spend unnecessarily. But once you start, you’re like why was I going to spend so much money on that CRV again when I can drive a nice, fuel efficient, Honda Fit? Not prestigious, but if you want to build wealth, some of the pride has to go…

Love this post. My main issue is always the emergencies and my fear of numbers. I look on spreadsheets and break out in cold sweats. I also LOVE food so it’s a lesson in self control BUT i will def try

Thanks! Dave Ramsey – another financial personality – recommends saving some money for emergencies first before you start paying off debt. Tracking spending is so important in curbing the impulse buys. Eating out is such a huge money sink! I know people who spend more than J$75,000 a month on dining out without even knowing it, then wonder where the money went.

I have actually been trying this without having a name for it. Wasn’t in an attempt to retire early but to just save as much as I possibly could for as long as I possibly could. Like you I started making a spread sheet for every month and I broke down my expenses by categories. Realised I was literally eating half of the money I budgeted to spend monthly. *facepalm*

Good job! You should definitely check out MMM.

I started this two months ago and you’re right, its amazing when you look back at how much you spend on the little things – ESPECIALLY FOOD! I started with a goal in mind (3 year plan for a house), but I feel it should be a permanent habit/way of life rather than a means to an end for a temporary goal. Best of luck! Hope you get to that 60% and I look forward to reading more! 😉

Thx! Love that I have some company.

Hi Lisandra: Thanks so much for visiting my blog! I found this post very interesting and I am sure that, in theory, this plan works. I have heard of it before. My problem is that I am already retired, so it is too late… But now that I am retired and can do what I ENJOY – I would highly recommend working towards early retirement in any way you know how, provided you have enough money to carry you along. Seriously, I never realized retirement would be so good! I am really living… 🙂

Lol, thanks for the comment! I love your tweets and took a look at your blog for the first time a few days ago. Great stuff!